Housing

Housing is a concern for many Murpyhsboro residents. Alchemy has put together a comprehensive plan to address these needs, with multiple entry points and solutions. This is not a “one size fits all approach” instead we present different options for different living situations. There is a lot of information here, and we encourage you to read it all before deciding on the course of action most suited to your situation. Alchemy is here to answer your questions today and in the future as you work to revitalize the housing market in Murpyhsboro.

Lack of affordable housing is a nationwide problem affecting U.S. cities and regions of all sizes and geographies. Put simply, there have been no viable large-scale solutions identified to address this country’s crippling housing shortage.

Deficits of quality affordable housing stock, whether for-purchase or rental units, are especially problematic for rural communities, especially cities like Murphysboro that have seen a population decline. The primary challenge faced by Murphysboro are similar to most rural communities: the cost to build or renovate does not equal what a seller should receive for the finished product. For example, a builder must price a new home at $180,000 in order to cover their costs and earn an acceptable profit, but the local buyers will only pay $150,000. Similar challenges are faced when an existing homeowner wants to renovate their home which can result in a loss should they seek to sell their property in the next few years. These challenges create a disincentive for investment by the builder or homeowner.

To determine development solutions to support new and renovated housing development, McClure reviewed and leveraged existing reports and conducted new research to create assumptions for total number of units. Analysis assessing blighted properties helped identify potential sites for redevelopment in existing neighborhoods and new development areas throughout the community. The resulting housing action plan will include recommendations for how best to use existing development tools and create new options to achieve Murphysboro’s goals improving housing options for current residents and to attract new ones.

For a full review of the housing assessment, see Appendix A Housing Needs Assessment.

Housing Challenges

Blighted housing was identified multiple times as a top issue by participants from the community visioning. Blight can be defined as properties that are vacant, abandoned, boarded up, dilapidated, or poorly maintained. Besides being an eyesore for neighbors, blighted properties directly impact a community’s sense of pride, lower a visitor’s impression of the community, potentially contribute to increased crime rates, and decrease surrounding property values. Even though they contribute little to no property taxes, blighted properties still require equivalent city maintenance costs as other structures, including waste cleanup, pest control, police, and fire.

The report, “Understanding the True Costs of Abandoned Properties: How Maintenance Can Make a Difference,” estimates that each property costs roughly $155,000 in its first year.

The problem lies in the cost gap; in other words, the cost to build new housing does not equal the return on investment to sell or rent this product. For this reason, a majority of new development is being built in communities much larger than Murphysboro such as neighboring Carbondale.

Another barrier that may impact a developer’s ability or desire to build in a community is the local permitting process. A community that seeks growth need to make the process of investing in the local housing market as transparent, predictable, and competitive as possible. The alternative is these developers will follow the path of least resistance to unincorporated Jackson County or nearby cities that may be more challenging to get permitted but result in a higher return on investment.

Stakeholder feedback and statistical analysis have identified challenges Murphysboro buyers face in affording for-purchase housing. Whether it is insufficient resources to afford a down payment, difficulty qualifying for traditional housing loans, or becoming cost-burdened by mortgage payments requiring more than 30% of their monthly income, these issues cause weaknesses in Murphysboro’s ability to transition residents from rental units to owner-occupied housing.

For more details on these challenges, see Appendix XX Housing Needs Assessment (LINK)

Key Strategies

Existing Tools & Resources

Create better awareness around available tools and resources and how they can be deployed

Land Bank

Create a land bank as the agency focused on housing redevelopment in Murphysboro & Jackson County

Revolving Loan Fund (RLF)

Establish loan and grant program to help provide resource for development of new housing and redevelopment of existing homes

Existing Tools & Resources

State & Federal Programs

There are existing state and federal resources that are available to help finance new or renovate existing homes. One of the best resources is the Illinois Housing Development Authority who provide resources that meet the needs of low-to-moderate income households as well as those at or right above the median household incomes. It should be noted, middle-class income households who earn between 80 and 120 percent of the area median income may not be eligible for these programs, but still face considerable barriers to housing. The local revolving loan fund (RLF) program would allow a community flexibility to set its own eligibility requirements and could help address this middle-class income challenge.

Providing both the public and local financial institutions with these funding opportunities has the potential to create new opportunities for property renovations and homeownership.

FHA 203K Loans Mortgage loan for a fixer-upper provides financing up to 110% of the after-improvement value to purchase and renovate a primary residence.

Fannie Mae – HomeStyle Renovation Mortgage Similar to FHA 203k loan but the property can be primary residence, rental property, or vacation home while FHA restricts use to primary residences only.

FirstlookREOMatch First Look is an online tool that provides first right of refusal to local entity working to stabilize a neighborhood.

USDA Single Family Housing Repair Loans & Grants Program provides up to $20,000 loan and $7,500 in grant funds to very-low-income homeowners to repair, improve or modernize their homes.

Illinois Housing Development Authority IDHA has a number of programs to help low and moderate income households with favorable mortgage terms and down payment assistance.

IHDA Single Family Rehabilitation (SFR) Program This program provides funding to units of local government and non-profit organizations throughout the State to help homeowners make necessary repairs to their homes.

For a more expanded list of programs and details, click here to download the Funding Resource Guide in Appendix C.

Residential TIF

Tax Increment Financing or TIF is the creation of a district where property tax revenues are frozen at a certain rate, which is set on a base assessed property value for a period of 23 years. Any taxes generated above that level can go back into redevelopment, either as rebates to developers or to the city for improvement of infrastructure within the designated TIF district. Residential TIF is a tool that can be used to direct these the increment funds towards new housing or the renovation of existing homes.

Marion, IL is an example of a community that recently created a residential TIF district. Their program focuses on revitalizing existing neighborhoods:

- 50% to 75% reimbursement on eligible rehabilitation projects, such as replacement of windows and siding and roof repairs, the addition of porches, ramps or stairs, demolition of crumbling outbuildings, and removal of dead trees and other landscaping needs;

- Forgivable down-payment assistance for first-time homebuyers;

- Development incentives for owner-occupied homes on vacant or dilapidated lots; and

- City would use funds to update water and sewer lines, sidewalks, streetlights and signage

For more details on the process of creating a Residential TIF district click HERE.

Community Stabilization Assessment Freeze

The state legislature passed the Community Stabilization Assessment Freeze Pilot Program in 2015. The program allows a county assessment officer the ability to reduce the assessed value of improvements to residential property for up to 10 years. The intent of the program is to help support renovations of owner-occupied homes in low- and moderate-income communities through deferring property taxes on the improved portion.

For example, a homeowner currently pays a property tax bill of $1,500 per year and the improvements increased the annual property tax bill by $1,000, for a total of $2,500. The program would pay for up to 90% of that increased value – i.e. $900 of the $1,000 – for a period of 10 years.

To enact this program locally, the city and county would have to adopt specific language outlining how the program would be implemented. For more information, see the full details of the program HERE.

For more details on the process of creating a Residential TIF district click HERE.

Create Your Own Land Bank

Though relatively new in Illinois, land banks are quickly gaining momentum as a critical tool to efficiently fight blight and revitalize communities. The most useful tool a land bank offers against blight is the ability to provide a clear title to new purchasers. These properties, which could be abandoned houses or foreclosed properties held by local banks, are typically those with unpaid back-taxes or other liens and liabilities which prevent it from being sold on the private market. Through a judicial deed process, the land bank may acquire abandoned property, leverage its legal ability to clear the title, and then find a qualified buyer to purchase and redevelop the property.

Some of the key benefits of a land bank include:

- Assists with community revitalization, particularly in community areas with low- and moderate-income households

- Stabilizes housing market while reducing the likelihood properties cycle through the tax sale process

- Allows municipalities and counties to come together using existing authority via intergovernmental agreement for greater efficiency

- Uses existing tools more effectively such as fast-tracking the disposition of abandoned properties

- Preserves property values and reduces municipal costs by intervening to save properties before they deteriorate and require demolition.

The land bank could be a part of or serve as the economic development role to support the revitalization of Jackson County with an emphasis on Murphysboro. The Illinois Housing Development Authority has created a program called the Land Bank Capacity Program (LBCP) and Technical Assistance (TA) Network to provide financial resources that can be used to help create a land bank. The TA Network funds would be used to help build capacity and get organized while the LBCP funds help provide the start-up capital to begin the work of a land bank.

For more details, review the Illinois Housing Development Authority’s program guide linked HERE.

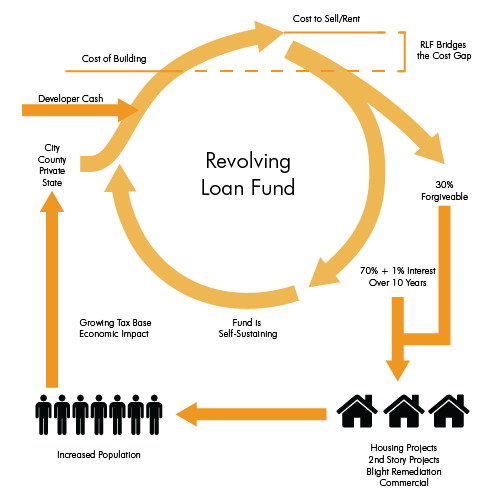

Create your own local housing fund: Revolving Loan Fund

What is clear from the community visioning sessions and stakeholder meetings is that developers remain cautious when pursuing housing activities in Murphysboro. This is due, in part, to the issue of recouping their investment – the cost to build does not match the return on investment. A revolving loan fund would provide a vehicle for employers and public sector partners to have “skin in the game” to address local housing challenges and reduce the financial risk to developers. Once the initial loans are repaid, funds could be reinvested into new housing and improvements of existing homes.

The goal of this fund is three-fold:

- Incentivize builders and developers to invest in Murphysboro;

- Build and renovate housing that is desirable and attainable for a majority of residents; and

- Create a self-sustaining fund.

A Revolving Loan Fund (RLF) is a source of financing, which may not otherwise be available within the community to support a particular need such as housing. A common use of RLF programs are to fill a “financing gap” when a business lacks the funds to meet the equity requirements of bank financing or needs a lower interest rate.

In the case of rural housing development, the return on investment is typically less than what can be realized in an urban market creating greater risk for a bank or private investor. Incentives such as fixed rate, low interest, and/or long-term financing are important factors to a business wanting to development in any community. Although the RLF is not the primary source of financing for a project, the combination of public and private financing lessens the risk for the primary lender by decreasing their exposure and yields an overall lower cost of money for the borrower.

Bridge the gap between the cost to build and the return on investment to sell or lease. In order to achieve affordable rental and/or new home prices, the city needs to work with local businesses and other stakeholders to create a revolving loan housing program to address the issue head on.

Upgrade Older Housing Stock.Finding ways to renovate and retrofit many older homes so that they comply with existing housing codes is something that should be given serious consideration. It is a great way to expand the availability of quality homes and attract younger families who may be willing to purchase older homes that have undergone major renovations.

Subsidy Calculations

In order to convince the city or a private business to invest in an RLF program, they must understand their ROI or return on investment. For employers it’s a pretty straightforward proposal that they will be able to fulfill or expand their employment needs if more people move into your community. However, local governments must look at the fiscal impact to their community, from property tax gains to increased funding for schools.

According to the Jackson County Assessor’s data, the average vacant infill lot in Murphysboro is assessed at approximately $1,050 and currently provides $112 in annual property tax revenue. Building a moderately priced home in an infill lot could increase that parcel’s assessed value to $18,662 with a total annual tax revenue of $2,000. Residential properties assessed in the top 20% of homes are assessed at a value of $25,964 or greater which would yield a minimum annual tax revenue of $2,783 per home. This means these property owners would immediately pay property taxes which help recoup the initial investment of the local taxing entities supporting the program (i.e. city, county, school, etc.).

Property Tax Revenue Comparison – Vacant Lot vs New Housing

| Tax Revenue by Levy | ||||||

| Assessed Value | CITY | COUNTY | SCHOOL | OTHER | TOTAL | |

| Vacant Lot | $1,050.00 | $19.22 | $18.56 | $49.01 | $25.77 | $112.55 |

| Infill Lot – Mid-level Home | $18,662.00 | $341.59 | $329.79 | $871.03 | $458.06 | $2,000.47 |

| Infill Lot – Higher-end Home | $25,964.00 | $475.25 | $458.83 | $1,211.84 | $637.29 | $2,783.20 |

A return on investment of ten years for property tax revenue would be an acceptable timeframe for repayment back to the RLF program. As a result, the subsidy would be $20,000 for an infill lot or home renovation and $30,000 for a new housing product valued at $175,000 – $250,000. Should a lot be provided as part of the local incentive, the available RLF subsidy would be reduced to $10,000 for to construct on an infill lot and $20,000 for a new housing product.

Recommended Subsidy Per Unit – Single Family

| Subsidy Available | ||

| Provide Own Lot | Free Lot Provided | |

| Infill Lot Redevelopment | $20,000 | $10,000 |

| Greenfield Site | $30,000 | $20,000 |

When comparing single family development to multi-family housing, there are greater property tax benefits to be realized on less amount of land. For example, consider a new 12-unit apartment complex with a proposed cost of construction at $1,000,000 (i.e. assessed value of $33,000 or $2,750 per unit). The developer requested incentives through tax abatement and infrastructure improvements which equates to a subsidy of $280,000 or $24,000 per unit. The total annual tax revenue from this complex would be $35,695.84. At this rate of return, it would take nearly eight years to recoup this subsidy investment.

Property Tax Comparison – 12-Unit Apartment vs Per Unit

| Tax Revenue by Levy | ||||||

| Assessed Value | CITY | COUNTY | SCHOOL | OTHER | TOTAL | |

| 12-unit Apartment | $333,000.00 | $6,095.23 | $5,884.68 | $15,542.44 | $8,173.49 | $35,695.84 |

| Per Unit | $27,750.00 | $507.94 | $490.39 | $1,295.20 | $681.12 | $2,974.65 |

Recommended Subsidy Per Unit – Multifamily Family

| Subsidy Available | ||

| Total | Per Unit | |

| 12-unit Apartment | $280,000 | $24,000 |

Lot Analysis

Housing Demand Matrix

The housing demand matrix is a tool utilized to determine the level of subsidy required to meet the perceived demands of the community. There are a variety of combinations to consider, however, analysis was conducted on three variations of the housing demand scenarios:

- Scenario 1: Convert Commuters to Residents

- Scenario 2: Housing for New/Expanding Businesses

- Scenario 3: Renovate/Replace Dilapidated Housing

The investment or subsidy funds needed to invest into the RLF will be split equally between the city of Murphysboro, Jackson County, Private Businesses, and the State of Illinois. It should be noted the city, county and private businesses must be invested first before requesting any financial support from the state to support this type of initiative.

| SCENARIO OPTIONS | NUMBER OF UNITS | TOTAL | |||

| Single Family | Multi-Family | ||||

| 1) Commuters | A1 | 13 | 6 | 19 | |

| 2) New Employees | B1 | 7 | 3 | 10 | |

| 3) Dilapidated Housing | C1 | 21 | 21 | 42 | |

| TOTAL UNITS | 41 | 30 | 71 | ||

| Added Population | 245 | 229 | 474 | ||

| Infill/Redevelopment¹ | 1x $20,000 | $575,652 | |||

| New Development² | 1x $30,000 | $370,062 | |||

| Multi-Family | 1x $24,000 | $ 24,000 | |||

| Donated Lot Discount³ | $10,000/each | $41,118 | |||

| Subsidy Total | $904,596 | $710,928 | $1,615,524 | ||

| ANNUAL CONTRIBUTION (FOR 10 YEARS)** | |||||

| City | 25% | $22,614.90 | $17,773.20 | $40,388 | |

| County | 25% | $22,614.90 | $17,773.20 | $40,388 | |

| Business | 25% | $22,614.90 | $17,773.20 | $40,388 | |

| State of Illinois | 25% | $22,614.90 | $17,773.20 | $40,388 | |

ASSUMPTIONS: (1) 70% of funds would be prioritized for infill/redevelopment; (2) 30% of funds would be prioritized to new development; (3)10% of new housing units are built on land donated for single-family housing

This option considers a more moderate approach developing a total of 92 single family units and 59 multifamily units over the next 10 years. The total subsidy required for this option is $3.45 million over a 10-year period or nearly $345,000 annually. Each funding partner would be required to invest nearly $86,000 into the fund on an annual basis.

| SCENARIO OPTIONS | NUMBER OF UNITS | TOTAL | |||

| Single Family | Multi-Family | ||||

| 1) Commuters | A2 | 39 | 17 | 56 | |

| 2) New Employees | B2 | 18 | 8 | 25 | |

| 3) Dilapidated Housing | C2 | 35 | 35 | 70 | |

| TOTAL UNITS | 92 | 59 | 151 | ||

| Added Population | 216 | 132 | 348 | ||

| Infill/Redevelopment¹ | 1x $20,000 | $1,285,956 | |||

| New Development² | 1x $30,000 | $826,686 | |||

| Multi-Family | 1x $24,000 | $ 24,000 | |||

| Donated Lot Discount³ | $10,000/each | $91,854 | |||

| Subsidy Total | $2,020,788 | $1,424,784 | $3,445,572 | ||

| ANNUAL CONTRIBUTION (FOR 10 YEARS)** | |||||

| City | 25% | $50,519.70 | $35,619.60 | $86,139 | |

| County | 25% | $50,519.70 | $35,619.60 | $86,139 | |

| Business | 25% | $50,519.70 | $35,619.60 | $86,139 | |

| State of Illinois | 25% | $50,519.70 | $35,619.60 | $86,139 | |

ASSUMPTIONS: (1) 70% of funds would be prioritized for infill/redevelopment; (2) 30% of funds would be prioritized to new development; (3)10% of new housing units are built on land donated for single-family housing

The third and final alternative analyzed is the is the most aggressive option building out more than 171 single family units and 113 multifamily units over the next 10 years. The total subsidy required for this option is $6.47 million over a 10-year period or nearly $647,000 annually. Each funding partner would be required to invest nearly $162,000 into the fund on an annual basis.

| SCENARIO OPTIONS | NUMBER OF UNITS | TOTAL | |||

| Single Family | Multi-Family | ||||

| 1) Commuters | A3 | 66 | 28 | 94 | |

| 2) New Employees | B3 | 35 | 15 | 50 | |

| 3) Dilapidated Housing | C3 | 70 | 70 | 140 | |

| TOTAL UNITS | 171 | 113 | 284 | ||

| Added Population | 216 | 132 | 348 | ||

| Infill/Redevelopment¹ | 1x $20,000 | $2,388,260 | |||

| New Development² | 1x $30,000 | $1,535,310 | |||

| Multi-Family | 1x $24,000 | $ 24,000 | |||

| Donated Lot Discount³ | $10,000/each | $170,590 | |||

| Subsidy Total | $3,752,980 | $2,714,640 | $6,467,620 | ||

| ANNUAL CONTRIBUTION (FOR 10 YEARS)** | |||||

| City | 25% | $93,824.50 | $67,866.00 | $161,691 | |

| 25% | $93,824.50 | $67,866.00 | $161,691 | ||

| Business | 25% | $93,824.50 | $67,866.00 | $161,691 | |

| State of Illinois | 25% | $93,824.50 | $67,866.00 | $161,691 | |

ASSUMPTIONS: (1) 70% of funds would be prioritized for infill/redevelopment; (2) 30% of funds would be prioritized to new development; (3)10% of new housing units are built on land donated for single-family housing

PILOT PROJECT AREA: HISTORIC BUNGALOW DISTRICT

Murphysboro is known for its historic bungalow houses spread throughout the community. There is one neighborhood in particular that has been identified by the Murphysboro Historic Preservation Committee. The neighborhood bound by Elm Street to the south and Hortense Street to the North, west to N 22nd Street and east to N 19th Street/N 18th Street bordered by the former Curwood plant property (future site of Solar Alliance solar energy installation).

The Longfellow Bungalow District would be a great area to pilot the REVOLVING LOAN FUND PROGRAM (RLF). There are 324 properties classified as “residential” with an estimated 179 or 55% owner-occupied and 145 or 45% renter-occupied housing. There are an additional 16 vacant lots within this designated area. The RLF program could help finance the development of infill housing units on vacant lots as well provide resources to renovate existing historic bungalow homes. The RLF program could also be used to provide incentives to landlords to sell their property to their renters and resources to the homeowners to make necessary repairs.

The program could adhere to the following guidelines:

- Homeowners could apply for up to $20,000 in repayable financing at a low-interest rate.

- 50% or up to $10,000 of the loan would be forgivable over a five-year with 20% forgiven each year of owner-occupancy. You must occupy the home for five years to receive the full forgiveness.

- Home must be a primary residence to qualify.

- Suggest restricting or eliminating use of home as a short-term rental (i.e. Airbnb).

The Historic Preservation Committee should establish design guidelines for renovations to maintain the historic character of the bungalow homes. Some common restrictions focus on the material type and color choices of the exterior structure. Similar programs also provide a list of eligible home repairs intended to make the home habitable and increase its overall marketability. The following is a list of common home repairs that RLF financing could be utilized for:

- Update on aged or unsafe heating, air conditioning, electrical and plumbing systems

- Roof repair or replacement

- Foundation repair

- Exterior siding repair or replacement and paint

- Window and door repair or replacement (if in poor condition repair or for energy efficiency)

- New garage, garage repair or replacement (maximum 2 car garage, 24′ X 24′)

- Energy efficiency (insulation, windows, mechanical upgrades)

- Access/architectural barrier removal and wheelchair or mobility assistive device

- Sidewalk and driveway repair or replacement

- Interior repairs and updates

- Functional landscaping (grading and retaining walls for water and erosion control, significant tree removal or trimming)

Property Tax Assessment Freeze

The Illinois Historic Preservation Division has a program that support the rehabilitation of historic homes through a property tax assessment freeze. The program freezes the assessed value of historic owner-occupied, principal residences for eight years, followed by a four-year period during which the property’s assessed value steps up until the 12th year, when it will be at its then-current level. This program is administered free of charge to Illinois homeowners who sensitively rehabilitate their historic homes.

To qualify for the program, the residence must first be owner-occupied and the owner’s principal residence. The following housing types can qualify:

- Single-family house

- Residential building with up to six units as long as the building owner resides in one of the units

- Condominium building

- Cooperative

Second, the building must be registered as historic either individually or as part of a historic district, such as the proposed Longfellow Bungalow District. The designation could be through the National Register of Historic Places, a designated local landmark or contributing property to historic district identified through a local preservation ordinance. Third, the residence must be rehabilitated in accordance with the Secretary of the Interior’s Standards for Rehabilitation (linked HERE). Lastly, the rehabilitation must have eligible expenses equal to or exceeding 25% of the property’s fair cash value, as determined by the local assessor, for the year the rehabilitation started.

While this program would be beneficial to residents in the proposed Longfellow Bungalow District, there are still several barriers to apply for these funds. First, the district would need to be designated as historic, either locally or through the National Register of Historic Places. Once approved, these homeowners would then need to either have enough savings or be able to apply for financing to make these improvements. This tool could be paired with one of the many previously mentioned existing financing resources or the RLF program for greater savings to the homeowner, although, this would extend the payback period for the forgivable loan portion of the RLF program. It might be a good option to allow participants in this program to repay the full amount of the RLF loan, including the forgivable portion, and then participate in the 12-year Property Tax Assessment Freeze Program.

Federal Historic Tax Credit

The Historic Tax Credit (HTC) program encourages investment in the rehabilitation and re-use of historic buildings. The federal tax credit allows program participants to claim 20 percent of eligible improvement expenses against their federal tax liability. The federal tax credit program follows much of the same eligibility requirements as the Illinois Property Tax Assessment Freeze program in addition to the requirement properties must be income-producing such as an apartment building, upper-story housing on main street or some other commercial use. The Longfellow Bungalow District is primarily made up of single-family homes, so this program is limited to use on rental properties only.

For more details on these programs, click here to download the Funding Resource Guide in Appendix C.